Introduction:

This backgrounder outlines the Bracebridge Chamber of Commerce’s advocacy focus on housing, highlighting the critical need for addressing housing affordability and development in Muskoka. It underscores the Chamber’s support for a range of strategic initiatives at the federal, provincial, and local levels. These initiatives include proposed legislative amendments for financial support in housing projects, embracing innovative housing solutions and workforce development, and fostering public education and community engagement. The document reflects the Chamber’s commitment to championing solutions that not only meet the housing demands in the region but also preserve the unique character and needs of the Muskoka community.

The table below compiles all recommendations we support in Bracebridge. The backgrounder as a whole goes more in-depth on why and how we support these recommendations.

|

Government Level |

Recommendation |

|

Federal |

Adjustment to amendments to the Excise Tax Act that removes GST on purpose-built rentals for projects currently under construction in addition to new builds. (Canadian Chamber of Commerce, 2023) |

|

Federal |

Changes to the Income Tax Act that would provide tax incentives for donations to Community Land Trusts. (Canadian Chamber of Commerce, 2023) |

|

Provincial, Federal, Local, Private |

Promote skilled trades careers as viable employment options, with intentional outreach to groups traditionally excluded, including women and other equity-deserving groups. (OCC, 2023) |

|

Provincial, Federal, Local, Private |

Share best practices around maximising occupancy of existing homes, buildings, and neighbourhoods, including co-living and co-ownership opportunities such as matchmaker services that facilitate shared living arrangements between “over-housed” seniors and students. (OCC, 2023) |

|

Provincial, Federal, Local |

Leverage surplus public lands and other assets for affordable housing development (i.e., by requiring that a portion of all government land sales include an affordable housing component). (OCC, 2023) |

|

Provincial, Federal, Local, Private |

Support the development and expansion of innovative technologies (e.g., modular construction and 3D-printed housing) and data tools (e.g., the Rural Housing Information System), including by sharing best practices across the province. (OCC, 2023) |

|

Provincial |

Continue to improve capacity and processes at the Landlord and Tenant Board to ensure swift access to justice for landlords and tenants, including by implementing recommendations from the recent Ombudsman of Ontario report. (OCC, 2023) |

|

Provincial |

Create rules and incentives through the Ontario Building Code and other policy levers to:

|

|

Provincial |

Identify buildings for potential conversion and investigate potential barriers, including land transfer taxes and the Ontario Building Code. (OCC, 2023) |

|

Provincial |

Clarify intent to address the loss of municipal revenue from development charges and set a fiscal policy to ensure the loss of this revenue will not impact municipal capacity for development. (OCC,2023) |

|

Local, Provincial, Federal |

Assess and implement best practices to promote public education and awareness around the value proposition of affordable housing development and gentle densification along the continuum. (OCC, 2023) |

|

Local, Provincial |

Continue to promote housing supply growth, missing middle solutions, and gentle densification, especially around transit, while minimizing disruption to natural assets, green spaces, agricultural lands, and employment lands. (OCC, 2023) |

|

Local, Provincial |

Develop a rental housing acquisition strategy to preserve the existing low-end of market rental housing, including by supporting community land trusts. (OCC, 2023) |

Business Impact:

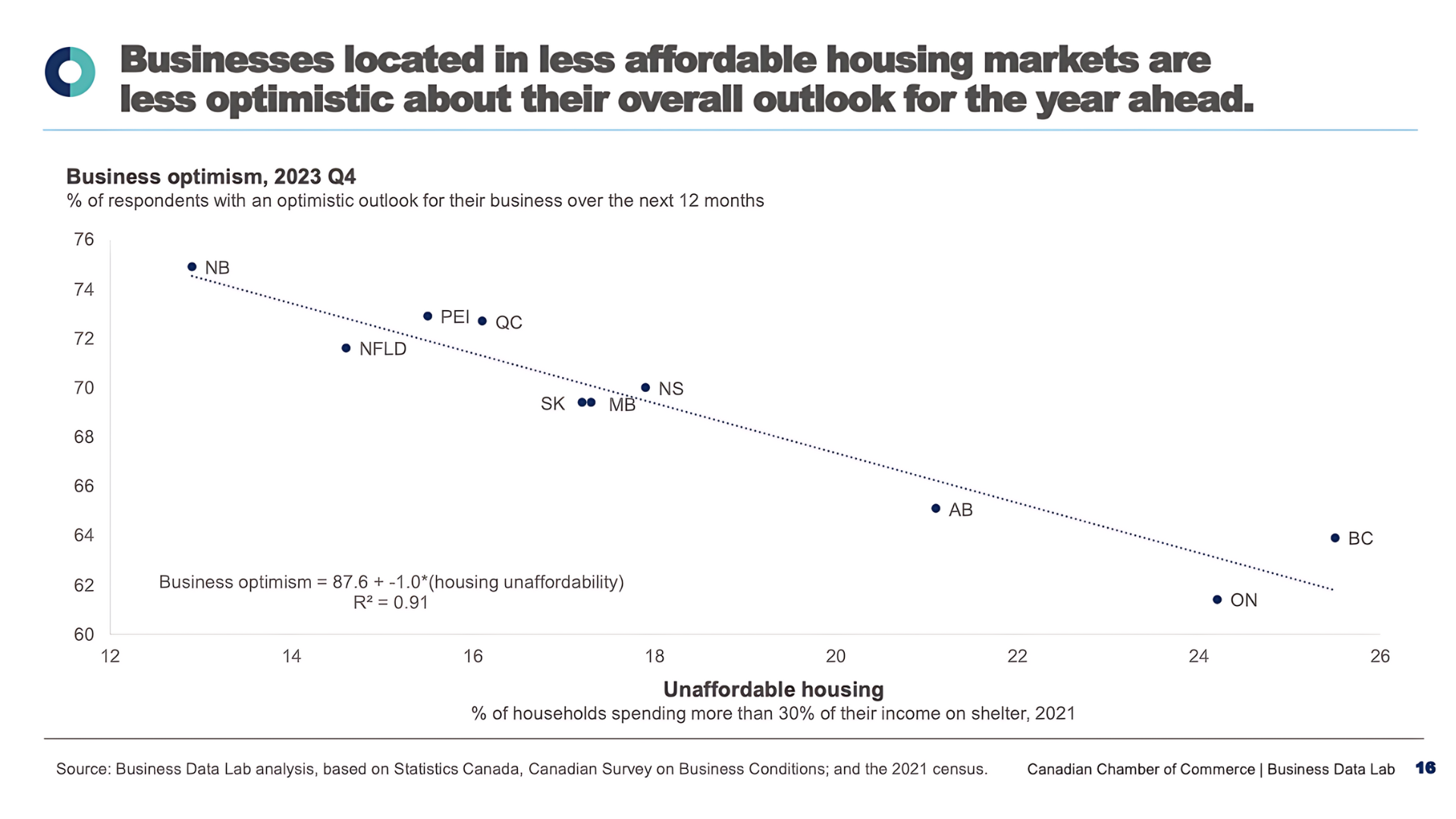

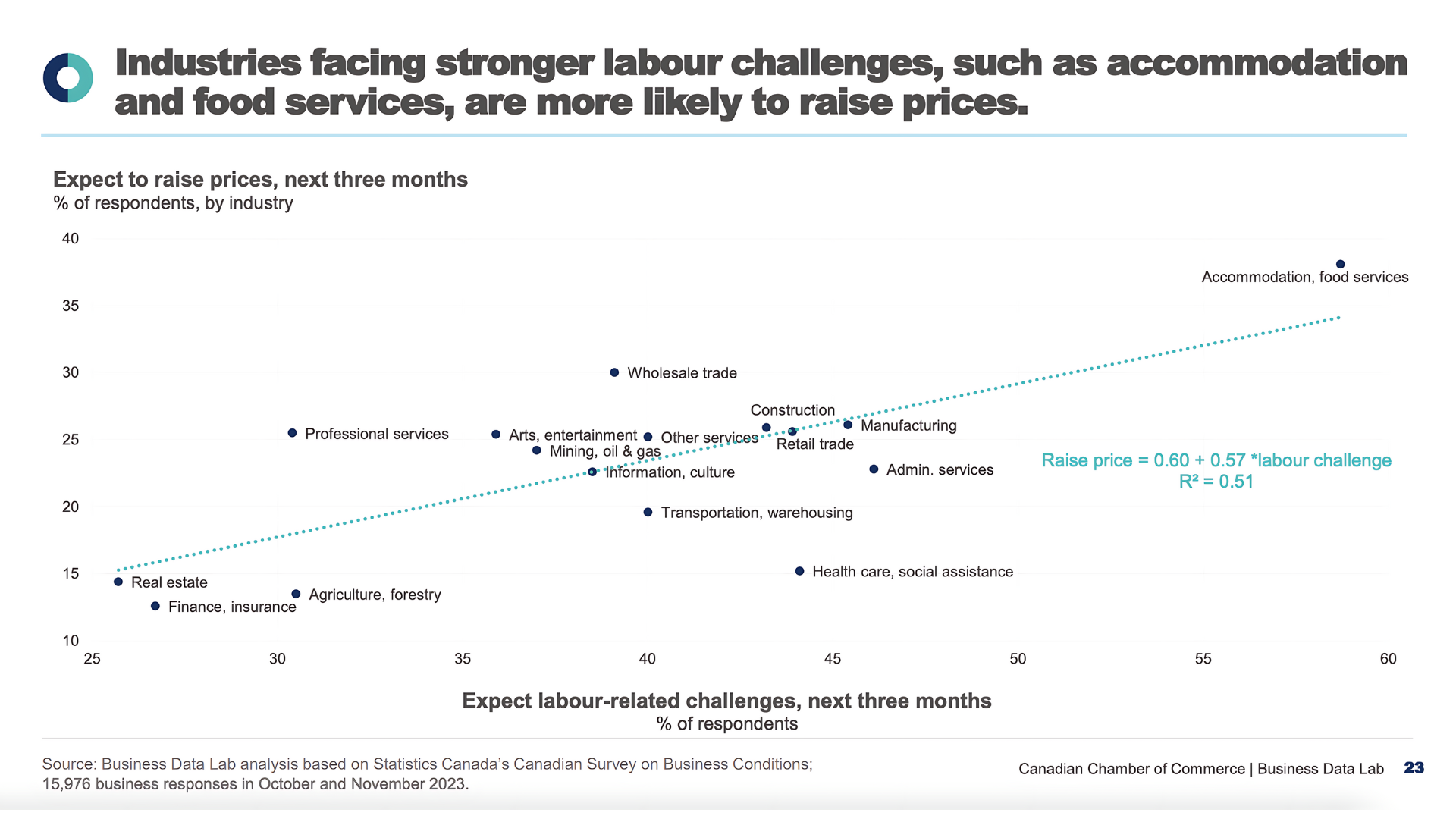

As businesses look for somewhere to invest, the ability to find staff is becoming increasingly more important. Housing troubles amplify labour problems. These two graphs take info from Statistics Canada and the Canadian Survey on Business Conditions and show that businesses are less optimistic in areas where housing is less affordable.

In addition to less optimism, the second graph also shows that businesses facing labour challenges are more likely to raise prices. Accommodation and food services are listed as the most likely sector to increase prices. Muskoka’s heavily tourism-based economy is more likely to see an impact from this sector increasing its prices.

Support at the Federal level:

Changes to the Excise Tax Act

Summary

The Canadian Chamber of Commerce has suggested an adjustment to amendments to the Excise Tax Act that removes GST on purpose-built rentals for projects currently under construction in addition to new builds.

The current amendment supports new builds starting after September 13, 2023 and before 2031, the changes suggested would also support builds that were currently in progress as of September 13, 2023.

Adjustment below(In red):

Rebate for purpose-built rental housing

(3.1) The amount of a rebate under subsection (3) in respect of a taxable supply of purpose-built rental housing — being prescribed property — is determined in accordance with subsection (3.2) if prescribed conditions are met and if

(a) the taxable supply is a supply by way of sale of a residential complex or an interest in a residential complex to a person that is not a builder of the residential complex, or of a residential complex or an addition to a residential complex to a person that is, otherwise than by reason of subsection 190(1), a builder of the residential complex or addition, as the case may be, and the construction or last substantial renovation of the residential complex or addition, as the case may be, begins after, or is underway as of, September 13, 2023 but before 2031 and is substantially completed before 2036; or

(b) the taxable supply is a supply by way of sale of a residential complex that is deemed to be made to a person that has converted real property for use as the residential complex and is, as a result, deemed under subsection 190(1) to be a builder of the residential complex and the construction or alteration necessary to effect the conversion begins after, or is underway as of, September 13, 2023 but before 2031 and is substantially completed before 2036. (Canadian Chamber, 2023)

Why we support this:

In conversation with the Town of Bracebridge we learned that 5,843 housing units have been approved across Muskoka with approximately half of these units being approved for more than ten years. It was made clear in this conversation that approval is not the only factor at play and there needs to be collaboration with the private sector.

As interest rates have increased in Canada and inflationary pressures impact construction costs, certain projects, potentially in Muskoka, have become unviable and do not progress further. This change will help the private sector take action more effectively and alleviate some of the financial pressures for purpose-built rentals.

Changes to the Income Tax Act:

Summary

The Canadian Chamber of Commerce, in it’s 2023 policy resolutions document has suggested a change to the Income Tax Act that would provide tax incentives for donations to Community Land Trusts.

Recommendations from the Canadian Chamber 2023 Policy Resolutions document

That the Government of Canada:

- Make amendments and additions to the Income Tax Act to incentivize the donation of land to Land Trusts, for the purpose of developing affordable housing, by utilizing the same mechanisms as those already provided in the Act for individuals and corporations to make donations to ecological land reserves.

- These changes will allow for donations of land to Community Land Trusts to be capital gains exempt IN ADDITION, a tax credit or deduction can be provided in exchange for the land, based on the fair market value. “ (Canadian Chamber Policy Resolutions, 2023)

Why we support this:

This exact model has proven to be quite successful for Ecological Land Reserves and should translate well to the Community Land Trust model. Muskoka has its own Community Land Trust which means this change would have an immediate potential impact on our community.

Support at the Provincial level:

The Ontario Chamber of Commerce released a document, Home Stretched Tackling Ontario’s Housing Affordability Crisis Through Innovative Solutions and Partnerships, which outlines a variety of suggestions at the provincial, federal, local and private levels. While we support the entire document, we have outlined specific recommendations that we believe will work best for Bracebridge and Muskoka.

Note: Many of the recommendations in this document require support from federal and local governments in addition to the provincial government and the private sector.

Skilled Trades Recruitment:

- “Continue to promote skilled trades careers as viable employment options, with intentional outreach to groups traditionally excluded, including women and other equity-deserving groups.” (OCC, 2023)

Why we support this:

Homes need to be built by people, qualified people. Not only can a skilled trade lead to a fulfilling career for the individual, it also grows our workforce and capacity to build homes. Ontario-based programs such as apprenticesearch.com work to promote skilled trades and should be supported by the provincial government.

Co-Living Solutions:

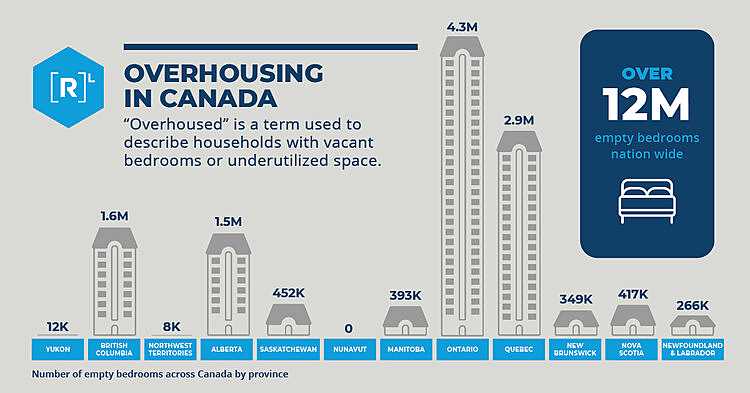

- Share best practices around maximizing occupancy of existing homes, buildings, and neighbourhoods, including co-living and co-ownership opportunities such as matchmaker services that facilitate shared living arrangements between “over-housed” seniors and students. (OCC, 2023)

Why we support this:

Census data from Statistics Canada shows us that the population in Muskoka is aging. The average age of a Bracebridge resident is 47.3, up from 46.3 in 2016. In addition to this, the district of Muskoka has a high percentage of single-family homes with multiple bedrooms. “81% of Muskokans live in detached homes, compared to 54% in Ontario as a whole” (District of Muskoka, Economic Development and Community Profile, March 2019) This combination makes Muskoka the perfect candidate for this type of solution.

Rlabs. Overhousing in Canada [Infographic]. Retrieved from https://rlabs.ca/overhousing-underhousing-in-canadian-real-estate/

Rlabs. Overhousing in Canada [Infographic]. Retrieved from https://rlabs.ca/overhousing-underhousing-in-canadian-real-estate/

Leveraging Surplus Public Lands:

- Leverage surplus public lands and other assets for affordable housing development (i.e., by requiring that a portion of all government land sales include an affordable housing component). (OCC, 2023)

Why we support this:

While we acknowledge the private sector plays an important role in solving the housing crisis, all levels need to be in crisis mode, that means using existing assets to help solve the problem. Surplus land from a government entity gives more control over the type of housing that can be built compared to the private sector where other factors including profitability are at play.

Innovative Technologies:

- Support the development and expansion of innovative technologies (e.g., modular construction and 3D-printed housing) and data tools (e.g., the Rural Housing Information System), including by sharing best practices across the province. (OCC, 2023)

Why we support this:

Historically, innovation is what drives prosperity the fastest. As many parts of the province face similar challenges to us we will learn about new solutions that we need to be ready to adopt as quickly as possible.

Landlord and Tenant Board:

- Continue to improve capacity and processes at the Landlord and Tenant Board to ensure swift access to justice for landlords and tenants, including by implementing recommendations from the recent Ombudsman of Ontario report. (OCC, 2023)

Why we support this:

We have heard from both landlords and tenants that the current system does not work for them. Improving all processes with the Landlord and Tenant Board will serve to make someone more likely to rent out a unit and will ensure the people living in rental units are more prosperous.

Ontario Building Code & Conversions:

- Create rules and incentives through the Ontario Building Code and other policy levers to:

- Develop accessible, mixed-use, climate resilient, and green housing supply.

- Retrofit, convert, and repurpose vacant buildings. (OCC, 2023)

- Identify buildings for potential conversion and investigate potential barriers, including land transfer taxes and the Ontario Building Code. (OCC, 2023)

Why we support these:

Mixed-use development is vital to the vibrancy of a community and would allow for more commercial space in addition to housing. In addition, building vacancy is virtually in every community, by incentivizing development wherever possible there is a higher chance an investor can be found to put serviced land to use.

Development Charges:

- Clarify intent to address the loss of municipal revenue from development charges and set a fiscal policy to ensure the loss of this revenue will not impact municipal capacity for development. (OCC,2023)

Why we support this:

The District of Muskoka and the lower-tier municipalities made it clear that the impact of less revenue from development charges is high in Muskoka. The loss of revenue cannot be passed off to the tax base and municipalities need other revenue-generating tools to address modern issues.

“From a District perspective, the overall reduction in maximum development charges applicable to all development may have the unintended consequence of stalling the building of critical infrastructure and shifting the financial burden of growth-related infrastructure needs onto existing property taxpayers. This is particularly worrisome as there is no additional funding proposed to offset the reduction in these fees, and no consideration of the additional administrative and financial costs of completing complex calculations and interpretations of potential exemptions, discounts and deferrals of development charges as captured in required agreements. This additional financial burden on existing residents will worsen the housing crisis, especially in those municipalities where residents are already paying significant taxes and are struggling to make ends meet. Further, if the reductions in Community Benefit and Development Charges are enacted, the Province must ensure that municipalities are financially supported to fund necessary municipal capital projects in order to maintain the existing high levels of service that Ontarians deserve. (District of Muskoka, Bill 23 – More Homes Built Faster Act – Background Information, November, 2022)

Support at the local level:

Support at the local level is where the Bracebridge Chamber of Commerce can have the most impact. We take pride in our great working relationship with the District of Muskoka and the Town of Bracebridge. Our local governments keep us informed on the issues they face and we have regular conversations offering consultation and asking questions about housing.

Public Awareness:

- Assess and implement best practices to promote public education and awareness around the value proposition of affordable housing development and gentle densification along the continuum. (OCC, 2023)

Why we support this:

NIMBYism, a term used to describe a person or group that does not want to see development near them often comes from a lack of awareness surrounding housing. Some can hear about an increase in density and think it will result in Muskoka losing its character. This is not the case, in fact, by increasing density in key urban areas we can support the need for additional housing by filling in gaps where the land is already in use, preventing sprawl and helping businesses by allowing more people to live close to them.

How we support this:

We will continue to share educational resources (Including this) related to affordable housing and densification to our members. Additionally, we are committed to educating ourselves at any opportunity by attending webinars and staying up to date on the latest trends for housing in Canada.

Housing Supply:

- Continue to promote housing supply growth, missing middle solutions, and gentle densification, especially around transit, while minimizing disruption to natural assets, green spaces, agricultural lands, and employment lands. (OCC, 2023)

Why we support this:

There is only so much land that can be developed and to ensure affordability it needs to be done in the right way. Attainable housing is, in part, a supply and demand issue. By increasing the supply of homes in an area we can meet demand.

Densification around transit and in urban areas also helps our businesses with staffing. If employees can live close to where they work the job gets more appealing and businesses will have a larger talent pool to select from.

Additionally, densification results in less stress on municipal resources by reducing the need to pave roads and service a larger distance.

How we support this:

We will be keeping a close eye on development applications and the content of Planning and Development committee meetings as they happen here in Bracebridge. When an opportunity to support the town in its efforts to increase housing supply presents itself we will do so. If we believe there is room to do more we will and have made that known as well.

Community Land Trusts:

- Develop a rental housing acquisition strategy to preserve the existing low-end of market rental housing, including by supporting community land trusts. (OCC, 2023)

Why we support this:

Community land trusts are an innovative way to ensure perpetual affordability and act as an entity that operates with the interests of the community above all else. The Muskoka Community Land Trust (MCLT) has proven in the early stages that it is an organization that can get stuff done.

How we support this:

We have been in conversations with the MCLT and support them through advocacy at the local level and commitment to committee work for projects that relate to Bracebridge. We support the early-stage idea of donating the arena lands on James Street to allow the MCLT to build mixed-use housing with commercial space on the lower floor.

Call to Local Developers:

The suggestions above serve to help move the needle for housing further. In order for us as an organization to help more we need information and perspectives from the private sector. If you are actively developing in Bracebridge or have an interest in doing so we want to learn more from you. Please reach out to us directly so we can work together and solve the housing crisis here in Muskoka.

Conclusion

Legislative changes and innovative housing solutions are crucial for addressing the critical need for affordable and attainable housing, which in turn supports the local business community. A stable housing market attracts and retains a skilled workforce, essential for business growth and economic vitality. The Chamber’s advocacy highlights the interconnectedness of housing affordability and economic prosperity, emphasizing that robust housing solutions are key to fostering a thriving business environment and a resilient community in Muskoka.

References:

Canadian Chamber of Commerce / Business Development Lab. (2023). “Q4 Community Social Business Creation Report.” Retrieved from https://bdl-lde.ca/wp-content/uploads/2023/12/2023_Q4_CSBC_EN_Report_Final.pdf

Canadian Chamber of Commerce. (2023). “2023 Policy Resolutions.” Retrieved from https://chamber.ca/wp-content/uploads/2023/12/2023_Canadian_Chamber_Policy_Resolutions.pdf

Canadian Chamber of Commerce. (2023). “Letter to the Finance Committee Regarding Bill C-56.” Retrieved from https://chamber.ca/wp-content/uploads/2023/11/Canadian-Chamber-of-Commerce-C-56-Letter-to-FINA.pdf

District of Muskoka. (2019). “Muskoka Economic Development Profile.” Retrieved from https://www.muskoka.on.ca/en/finance-and-administration/resources/Documents/DMM-Economic-Development-Profile—Website-File-Size.pdf

Muskoka District Council. (2022). “Council Meeting Documents.” Retrieved from https://muskoka.civicweb.net/filepro/documents/39332/?preview=39347

My Muskoka Now. (2023). “District of Muskoka is Growing Older According to 2021 Census.” Retrieved from https://www.mymuskokanow.com/118483/news/district-of-muskoka-is-growing-older-according-to-2021-census/

Ontario Chamber of Commerce. (2023). “Housing Affordability Brief.” Retrieved from https://occ.ca/wp-content/uploads/OCC-Housing-Affordability-Brief.pdf

Rlabs. (N.D). “Overhousing in Canada [Infographic].” Retrieved from https://rlabs.ca/overhousing-underhousing-in-canadian-real-estate/

Statistics Canada. (2021). “2021 Census Profile for Muskoka.” Retrieved from https://www12.statcan.gc.ca/census-recensement/2021/dp-pd/prof/details/page.cfm?Lang=E&GENDERlist=1,2,3&STATISTIClist=1,4&HEADERlist=0&DGUIDlist=2021A00033544&SearchText=Muskoka